Agenda item

Minutes:

The Director of Economic Development submitted for the Committee’s consideration the following report:

“1.0 Purpose of Report

1.1 The purpose of this report is to update the Committee on the new Northern Ireland Enterprise Support Service (NIESS) – the regional initiative to support business start-up and growth, which will be led by Belfast City Council on behalf of the eleven councils and to seek approval to proceed with the appointment of contractors, pending receipt of the final MoU from the funder.

2.0 Recommendations

2.1 The Committee is asked to:

i. note the update on the new NIESS, including the planned go-live date for the new intervention;

ii. note that the final funding agreement/MoU (Memorandum of Understanding) has not yet been received from the Department for Levelling Up, Housing and Communities;

iii. note that officers have reviewed and commented on draft versions of the MoU; and

iv. agree that the Chief Executive can, under delegated authority, authorise the appointment of the contractors for the communications and marketing; call handling and service delivery (Engage and Foundation; Growth and Scaling lots) and any other eligible project expenditure, pending receipt and signature of the final MoU.

3.0 Main Report

3.1 At the meeting on 17th February, the Committee agreed that the Council should lead on the submission of an application to UK Shared Prosperity Fund (UKSPF) for the eleven-council Enterprise Support Service. It also agreed that, subject to additional due diligence and risk management work, the Council should lead on the future development and delivery of the service on behalf of the eleven councils.

3.2 Since that time, a significant amount of work has taken place to finalise the detail of the programme content, start the commissioning process of the new service and set in place the delivery structures so that it can become operational from Autumn 2023. Given the complex nature of the work, this has involved input from a range of council teams including Legal Services; Corporate Procurement Services; Finance; Human Resources and Continuous Improvement; Digital Services; Audit, Governance and Risk; Information Governance and Communications and Marketing. The work is being led by the Enterprise and Business Growth team. A March 2023 workshop, facilitated by Audit, Governance and Risk Services, helped identify initial risks and associated mitigations and these have guided the interactions with the teams since that time.

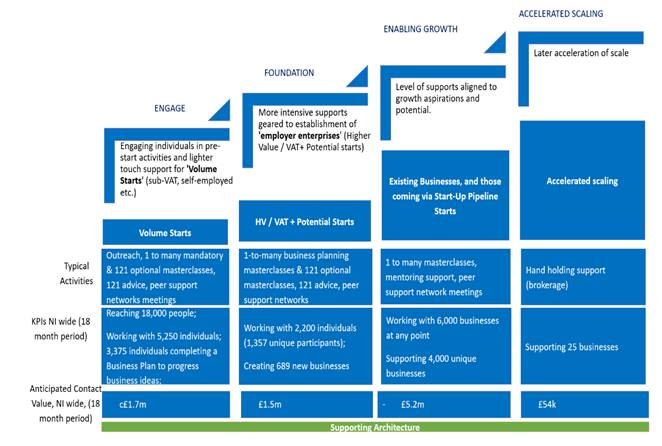

3.3 The service is being funded through the new Shared Prosperity Fund (SPF). This is the UK Department for Levelling Up, Housing and Communities’ (DLUHC) fund that was established as a replacement for EU funding (ERDF and ESF). One strand of funding focused on “Supporting Local Business”. The Investment Plan for UKSPF in Northern Ireland was launched in December 2022. At that time, the Plan proposed that a central component of the Supporting Local Business strand would be the eleven council Enterprise Support Service. An indicative financial allocation of £17million - £12 million programme delivery and £5million for small grants – was set aside for the service. UKSPF funding is available to March 2025 so the initial programme period will run from Autumn 2023 to March 2025. The service overview is detailed below:

Commissioning of Service Delivery

3.4 Taking account of the capacity in the marketplace, the procurement approach for delivery of the business support services (i.e., 121 mentoring support; masterclasses; peer support networks) was broken down into two main areas, namely:

· Engage and Foundation

· Growth and Scaling.

3.5 For both areas, there was a significant focus on ensuring that the needs of the local business base could be considered – given the differences in business sectors, composition, and development needs across the council areas.

3.6 An initial procurement exercise for both areas was undertaken in March/April 2023. However, for different reasons, it was not possible to appoint preferred suppliers in either of the areas. As a result, additional market engagement was undertaken to re-scope and re-shape the documentation in a way that could ensure delivery of the original ambitions while reflecting market feedback – and taking account of the expectations of each of the 11 council partners. The Growth and Scaling submissions are currently being assessed and bidders will be appointed in the coming week. The Engage and Foundation submissions are due to close on 21st August and preferred bidders should be appointed by the end of August. The start date for the new service is 1st October, 2023.

3.7 In addition to the delivery elements, there are several support elements that are being commissioned or developed in parallel. These include:

· Marketing and communications: this work is being led by Derry City and Strabane District Council. They have completed a procurement exercise for a marketing and communications agency to support with a range of activities including advertising, promotional and brand development. While DCSDC will lead on these elements of work, they will work directly with the overall Programme Lead and the wider team based in the Council, ensuring that there is a singular approach to delivery

· Call handling: the Go for it programme benefitted from a freephone number through which business and entrepreneurs could be directed to the relevant delivery agent. That support will continue under the new service; however, it will be extended to cover the full scope of enquiries from entrepreneurs and new and existing businesses

· CRM: to track all business engagement with the service and support the development of relevant reports for funders and individual councils, a customer relationship management (CRM) system is being developed. The Council’s Digital Services team is taking the lead on this, and they will be supported by other council services such as the Information Governance Unit (IGU) and Legal Services to ensure compliance with all relevant obligations. The CRM will also be guided by the council’s finance and grants management teams, ensuring that it can provide adequate assurances and information required, as set out in the funding agreement.

3.8 At present, the Council is still awaiting an MoU from the funder. As such, we are not able to proceed with the appointment of any of the contractors. The procurement exercises for the marketing and call handling have already concluded and the Growth and Scaling contract assessment will be complete by mid-August 2023; with the Engage and Foundation to follow by end August. As time progresses, this presents additional risks for service delivery, given that the end date of March 2025 cannot be extended. Officers have already reviewed the document and have provided commentary on the draft versions, in order to ensure that it is in line with our processes. As at 10th August, DLUHC officials has confirmed that the MoU is with their Ministers for signature but that it cannot release it until it is signed off officially. It has provided official confirmation that, “once approved, the project and all delivery partners can benefit from funding towards costs incurred from 1 April 2023, where this has been profiled in the project application”.

3.9 In the absence of the final MoU, members are asked to delegate authority to the Chief Executive to authorise appointment of the contractors for the communications and marketing; call handling and service delivery (Engage and Foundation; Growth and Scaling lots) and any other eligible project expenditure. All contracts will have appropriate clauses and conditions to confirm that they are subject to funding.

3.10 For Belfast – and all councils – this new service represents an important step forward in the councils positioning their intent to drive their local economies – with an increasing focus on support for indigenous businesses. This is reflected in the draft Belfast Agenda. This new approach also ensures that the councils, as a collective, can have a strong voice in the development of DfE’s new Entrepreneurship Strategy which will be a key pillar for the delivery of the 10x ambitions. It is also important to note that there is a limited window of opportunity in which to make progress so councils will be focused on ensuring that the new service works effectively to meet business needs. However, they will also need to consider how they can position the new service to attract additional funding for delivery after March 2025 – recognising the challenges in the public sector investment environment at present.

Programme Governance and Management

3.11 The original development work on this service was undertaken under the auspices of the SOLACE Economic Development Group (EDG), of which Belfast is the Chair. The EDG subsequently assigned the detailed work plan activities to a working group comprising all councils – again led by Belfast as the Lead Council. All key programme decisions have been escalated to the SOLACE EDG for endorsement, as delegated by SOLACE.

3.12 As the service moves towards the mobilisation phase, new governance structures will be put in place to support contract management, assurance, and reporting. It is proposed that this will include an internal delivery team across the council. This is likely to incorporate the services referenced at 3.2.

3.13 Regular reports will also be brought to CMT and to the City Growth and Regeneration Committee. At a regional level, there will be a programme management structure involving the appointed contractors and key officers from the PMO. The Programme Lead will report on a quarterly basis to SOLACE Economic Development Group and any matters requiring escalation to SOLACE will be agreed and actioned at those meetings.

Financial and Resource Implications

3.14 The Council will act as the lead council on behalf of the eleven councils for delivery of the service. To do so, we will establish a delivery and management team which will be fully resourced through the DLUHC funding.

3.15 The final budget is subject to completion of the relevant procurement exercises detailed above. The overall indicative SPF budget is in the region of £5million revenue in year 1 and £7million revenue in year 2, with around £5million available across the funding period for grant support.

Equality or Good Relations Implications/

Rural Needs Assessment

3.16 An equality impact assessment for the service has been completed. Local targets for delivery in each council area have been established and will be part of the contractual commitments with delivery partners.”

The Committee adopted the recommendations.

Supporting documents: